Must-Read China Economic News (Sept. 26 - Oct. 9)

RRR cut; Mortgage rate cut; Stock market boom; National Day holiday...

Greetings and welcome to the latest edition of Peking Ensight! We're thrilled to have you join us once again as we navigate the ever-evolving landscape of the Chinese economy.

⭐Under the Spotlight

KEY MACROECONOMIC INDICATORS:

1. International Trade

The value of China's international trade in goods and services reached approximately 4.18 trillion yuan (590.14 billion USD) in August this year, marking an increase of 4 percent year on year, official data showed.

In U.S. dollar terms, the country's exports of goods and services amounted to 322.4 billion U.S. dollars, while imports totaled 263.5 billion dollars, recording a surplus of 58.9 billion dollars, the State Administration of Foreign Exchange said.

The export value of goods reached nearly 2.07 trillion yuan while the import value of goods totaled about 1.5 trillion yuan, resulting in a surplus of 572.4 billion yuan.

The value of exported services amounted to 230.8 billion yuan and the value of imported services stood at 383 billion yuan, producing a deficit of 152.2 billion yuan.

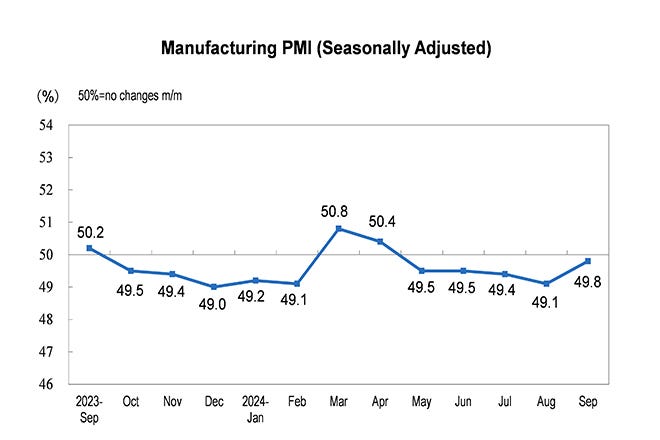

2. PMI

China's manufacturing sector registered a faster recovery in September as the government stepped up policy support to unleash domestic demand and bolster the economy.

The purchasing managers' index (PMI) for China's manufacturing sector came in at 49.8 in September, up from 49.1 in August, official data showed.

The reading marked the highest notch in the recent five months and ended a two-month decline, according to the National Bureau of Statistics (NBS).

NBS statistician Zhao Qinghe said that the improved PMI indicates manufacturing activities gained momentum this month, showing better performance.

3. ODI

China's non-financial outbound direct investment (ODI) increased 12.4 percent year on year to 94.09 billion U.S. dollars in the first eight months of the year, data from the Ministry of Commerce showed.

The data showed that Chinese companies' non-financial ODI in Belt and Road partner countries reached 20.51 billion U.S. dollars, up 2.2 percent from the previous year.

During the same period, the turnover of contracted overseas projects by Chinese companies amounted to 97.34 billion U.S. dollars, an increase of 5 percent, and the value of newly signed contracts rose 21.1 percent to 149.5 billion U.S. dollars.

The turnover of contracted overseas projects undertaken by Chinese companies in Belt and Road partner countries stood at 78.47 billion U.S. dollars during the period, up 3.6 percent year on year, while the value of Chinese companies' newly signed contracts in these countries reached 123.21 billion U.S. dollars, up 18.8 percent, the data showed.

POLICY BOOSTS

RRR Cut

China's central bank has announced a cut in the reserve requirement ratio (RRR) by 0.5 percentage points for financial institutions.

Starting from Sept. 27, the weighted average RRR for lenders will come to around 6.6 percent, while those having already implemented a 5 percent RRR will not be involved, according to a statement of the People's Bank of China.

The central bank adheres to a supportive monetary policy with a strengthened intensity and more targeted regulation to create a sound monetary and financial environment for stable economic growth and high-quality development, the statement said.

Stabilizing Property Market

The People's Bank of China and the National Financial Regulatory Administration rolled out a wave of policies to stabilize the real estate market.

The mortgage rates for first homes, second homes and more are required to be reduced no lower than 30 basis points below the loan prime rate (LPR) by Oct. 31, 2024 to ease financial burdens on property owners.

In principle, 18 national commercial banks need to release their plans for adjustments before Oct. 12.

The minimum down payment ratio for individuals' commercial housing mortgages will be lowered to no less than 15 percent for both first-home and second-home purchases.

The pricing mechanism for interest rates of individuals' commercial housing mortgages will be refined so that the rates can be adjusted dynamically based on agreements between borrowers and banks.

A BOOM OF STOCK MARKET

After the stimulus policy announcement, China's stock market has shown consecutive jumps. On Sept. 27, the benchmark Shanghai Composite Index up 2.88 percent at close.

The Shenzhen Component Index soared 6.71 percent, while the ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, jumped 10 percent.

On the last day of September, Chinese stocks continued strong performance, with the benchmark Shanghai Composite Index surging 8.06 percent, and the Shenzhen Component Index soared 10.67 percent. China's Nasdaq-style ChiNext Index jumped 15.36 percent that day.

After the seven-day National Day holiday on Oct. 8, major stock indices opened over 10 percent higher than the previous trading day.

In the meantime, the combined turnover of China's Shanghai and Shenzhen bourses reached 3.45 trillion yuan on Oct. 8, surpassing the 2.59 trillion-yuan turnover recorded on Sept. 30 and hitting a new high.

NATIONAL DAY HOLIDAY

China's National Day holiday ignited a surge in consumer activity, fueled by a dynamic blend of travel demand and targeted incentives, highlighting the strong economic vitality of the world's second largest economy.

Over the seven-day holiday ending on Oct. 7, more than 2 billion cross-regional trips were made nationwide, according to the Ministry of Transport, representing a 4.1-percent average daily increase compared to 2023.

The surge in travel not only boosted tourism-related industries but also stimulated consumer spending across various sectors -- highlighting the resilience of China's domestic market during and beyond the holiday period.

The holiday unleashed a travel frenzy. During the holiday period, a remarkable 765 million domestic trips were made, marking a 5.9 percent year-on-year increase, with total tourist spending surging 6.3 percent to 700.8 billion yuan.

The holiday also sparked a wave of consumer activity, with government-backed incentives playing a key role in heating up the market.

China unveiled an action plan in March this year to implement a program of large-scale equipment upgrades and trade-ins of consumer goods to expand domestic demand, and stepped up policy support in July with an extra funds injection of 300 billion yuan via ultra-long special treasury bonds.

Encouraged by the trade-in policy and automaker discounts, the holiday period saw new car sales increase by 11.7 percent -- with new energy vehicle sales surging 45.8 percent year on year.

During the holiday, JD.com, a leading online retailer, reported an increase of 67 percent in home appliance sales compared with 2023, while home appliance retailer, Suning, saw trade-in orders rising by 132 percent year on year.

BILATERAL RELATIONS

Trade dispute between China and Canada

China has filed a complaint at the World Trade Organization (WTO) over Canada's unilateralism and trade protectionism practices, a spokesperson for the Ministry of Commerce said.

The spokesperson said the country has also initiated an anti-discrimination probe into Canada's restrictive measures targeting certain imports from China.

The spokesperson made the remarks in response to Canada's announcement in late August that it will implement a 100-percent surtax on all Chinese-made electric vehicles, effective Oct. 1, 2024, and impose a 25-percent surtax on imports of steel and aluminum products from China starting Oct. 22, 2024.

The spokesperson said the Canadian side should view bilateral economic and trade cooperation rationally and objectively, respect facts, abide by the WTO rules, and not go further down the wrong path.

China will take all necessary measures to firmly safeguard the legitimate rights and interests of Chinese enterprises, the spokesperson added.

Phone talk between Chinese commerce minister, U.S. commerce secretary

China's Commerce Minister Wang Wentao held a telephone talk with U.S. Commerce Secretary Gina Raimondo on Oct. 8.

Wang said that China is willing to work with the United States on the basis of mutual respect, peaceful coexistence, and win-win cooperation to jointly implement the consensus reached at the San Francisco meeting, and put China-U.S. relations back on the right track.

Wang expressed serious concerns about the U.S. semiconductor policy towards China and the restrictions on Chinese connected vehicles.

It's necessary to clarify the national security boundaries in the economic and trade field, as it is conducive to maintaining the security and stability of the global industrial and supply chains, and creating a favorable policy environment for cooperation between the business communities from the two countries, Wang stressed.

China urges the U.S. side to pay attention to the specific concerns of Chinese enterprises, promptly lift sanctions on Chinese companies, and improve the business environment for Chinese companies in the United States, Wang said.

The phone conversation is an arrangement under the communication mechanism between the two commerce departments.