In the face of high U.S. tariffs, China is encouraging its exporters to pivot toward the domestic market, aside from urging them to continue diversifying foreign trade partners. But, what's the rationale behind this move and what supportive measures have been taken? It is also worth considering the prospects of this strategic shift.

RATIONALE BEHIND THE SHIFT

Due to higher tariffs, Chinese exports to the U.S. will become more expensive -- hurting their competitiveness. With China being the world's second-largest economy and second-largest consumer goods market, redirecting to domestic consumers is expected to help absorb shocks and mitigate losses for Chinese export-oriented businesses.

What's more, China has been trying to re-balance its economy towards consumption-driven growth after decades of export-led growth. A pivot to the domestic market aligns with this ambition and shouldn’t be regarded as forced or involuntary.

China has been pursuing a "dual-circulation" development pattern, which takes the domestic market as the mainstay while allowing domestic and international markets to reinforce each other. Addressing an over-reliance on external markets and tapping into the potential of its huge domestic market is likely to deliver long-term benefits for China, as high tariffs disrupt international trade and cause more uncertainty for the world economy.

Noticeable progress has been made after years of efforts aimed at "the integration of domestic and foreign trade." In 2024, more than 80 percent of Chinese exporters were simultaneously engaged in domestic sales activities.

"Helping foreign trade enterprises expand domestic sales is not a temporary measure employed to deal with the impact of tariffs, but a strategic adjustment for China to build a new development dynamic," said Tu Xinquan, dean of the China Institute for WTO Studies at the University of International Business and Economics in Beijing.

POLICY BACKING AND INDUSTRY SUPPORT

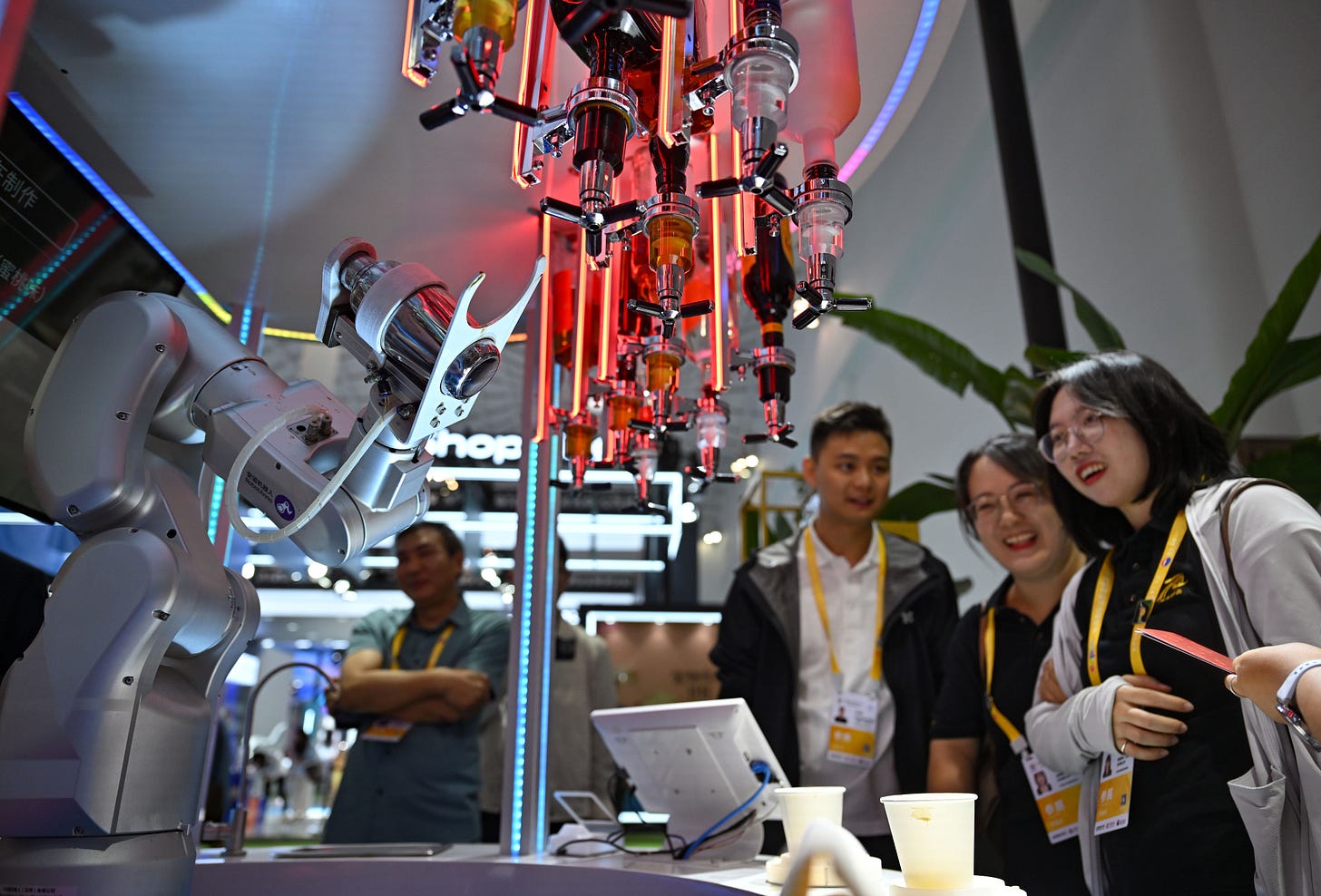

The Chinese government, both at top and local levels, introduced policy backing for exporters immediately after the latest trade tensions became apparent, while the country's e-commerce giants are using one of the world's most advanced e-commerce ecosystems to accommodate tariff-hit firms.

To help firms in the export industry make the most of their domestic market, China's Ministry of Commerce has met with industry associations, major retailers and distributors, exploring approaches to broaden domestic sales channels for export-oriented firms.

A recent initiative taken by the ministry is the stimulation of domestic consumption of export products. Under this scheme, quality export products have been taken to supermarkets, stores and online retail outlets nationwide, while also being included in the consumer goods trade-in program.

China's industry associations, major retailers and e-commerce platforms have also made contributions in this regard, establishing channels to put export-blocked inventory on shelves and helping export-focused firms better adapt to the Chinese market.

E-commerce giant JD.com, for instance, has set up a procurement fund totaling 200 billion yuan (about 27.7 billion U.S. dollars) for massive purchasing of export-oriented products over the next year.

Tencent, owner of China's most widely-used messaging service WeChat, on Thursday launched the "Foreign Trade New Journey Boost Plan." This initiative allows foreign trade companies to broaden domestic and foreign markets through 10 measures -- including green channels for opening stores, incentives for new merchants, traffic support and fee discounts. Through a combination of WeChat's small programs, online stores and offline stores, sales of foreign trade companies are expected to increase by 100 billion yuan, Tencent said.

Notably, other popular e-commerce platforms such as Meituan, Douyin, Kuaishou and Vip.com have also announced similar initiatives. In addition, brick-and-mortar stores of retailers such as Freshippo, an Alibaba-owned retail platform for groceries and fresh goods, Yonghui, CR Vanguard and Lianhua, are also working to help the products of exporters reach Chinese consumers.

CHALLENGES AND OPPORTUNITIES

Chinese exporters trying to find a foothold in the domestic market won't find it easy, despite considerable goodwill and policy support. Their products, designed to meet the needs and tastes of foreign consumers, may not be readily embraced by Chinese consumers.

"In the process of exploring the domestic market, some foreign trade enterprises may face problems such as channel differences and different market demands," said Shao Honghua, director of the trade digitization committee of the Statistical Society for Foreign Economic Relations and Trade of China.

"Industry associations and platforms are providing timely support and assistance, which creates buffer space for export-oriented enterprises to increase domestic sales," Shao said.

There have also been concerns that price wars will result from more exporters making forays into the already crowded home market. However, these fears have since been dismissed by experts.

Hong Junjie, vice president of the University of International Business and Economics, said products originally meant for exports entering the home market will intensify competition, but that the impact shouldn't be overstated.

"The proportion of exports shifting to domestic sales is very low. We have made a preliminary calculation and found that their market share is unlikely to exceed 5 percent," said Hong.

"Meanwhile, some of our foreign trade commodities can better meet consumption demands at different levels in China, which will also lead to the emergence of some new demands and achieve the effect of consumption upgrading," he added.

Dong Yu, executive vice president of the China Institute for Development Planning at Tsinghua University, shared Hong's opinion.

"Adding more high-quality foreign trade products on the supply side is conducive to providing domestic consumers with more choices," Dong said.

“But at the same time, it is also necessary to guide enterprises to view the situation correctly, enhance their competitiveness by constantly innovating products and services, and jointly expand the market pie," he added.