🚢 China’s exports shrink as global demand wanes. What's next?

China reported the first drop in exports in more than two years. Will the downward trend continue?

China’s exports dipped 0.3 percent year on year in October in the U.S. dollar terms, the first drop since June 2020, data from the General Administration of Customs showed.

Growth has actually slowed for three months. Export grew 7.1 percent over a year earlier in August, sharply down from a rise of 18 percent in July. It further slowed to 5.7 percent in September.

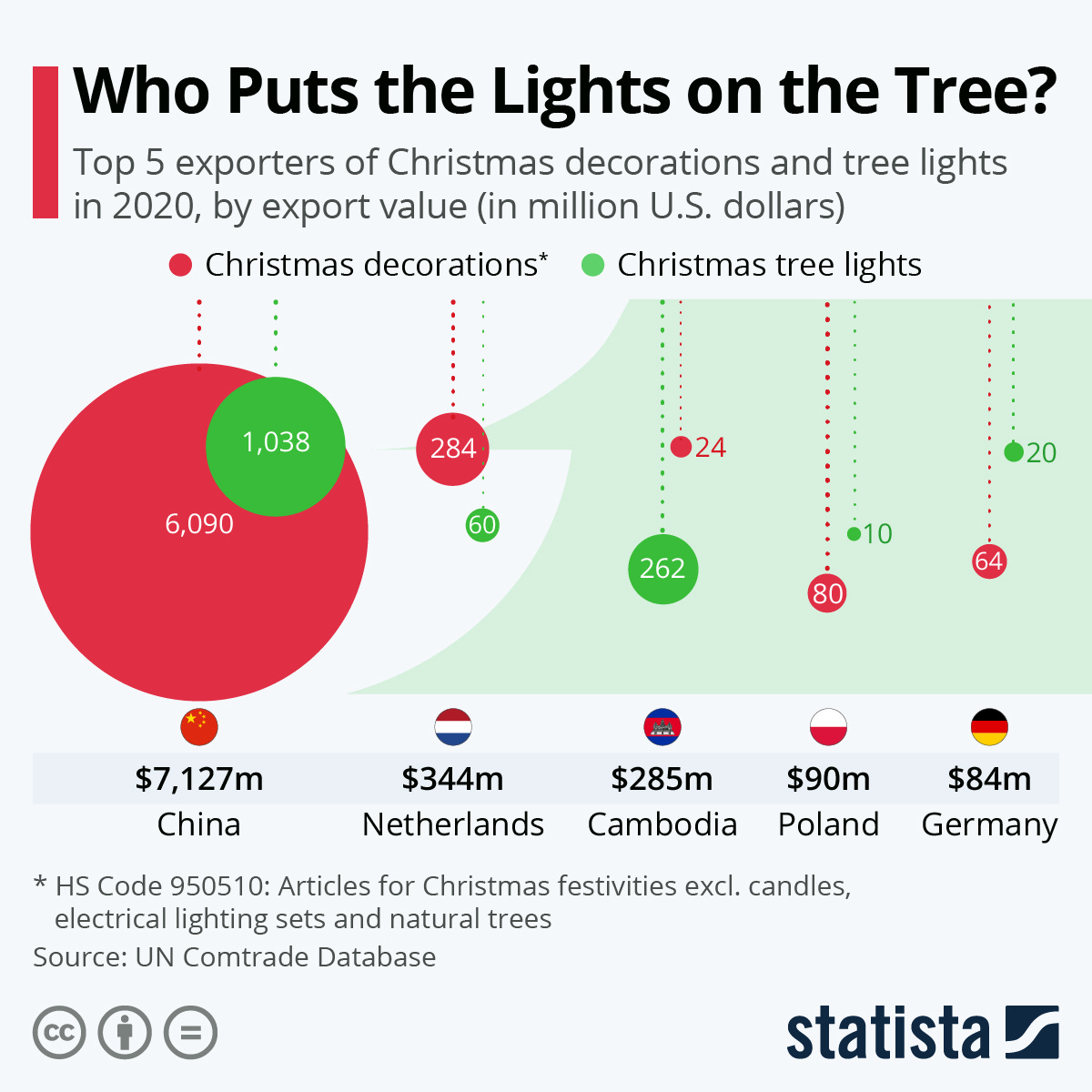

Disappearing Christmas Orders

Zhou Junzhi, chief macro analyst at Minsheng Securities, attributed the slowdown in exports to fewer Christmas orders compared with previous years.

The month of October is traditionally an export season, as buyers around the world are stocking up for the upcoming year-end shopping season, but that is not the case for this year, she observed.

A close look at October’s export structure showed that outbound shipment of toys shrank 18 percent year on year, and that of home appliances were down 25 percent in value.

Zhou said global demand for consumer goods, such as electric appliance, furniture and personal protective equipments has been poor since August and these sectors further cooled in October.

Meanwhile, U.S. retailers have reported relatively high inventories of these products since July, she said.

Tepid Global Demand

Behind China’s weaker-than-expected data is a global economic downturn that dented demand.

The S&P Global U.S. Manufacturing PMI stood at 50.4 in October, the lowest reading in two years and a half. Meanwhile, a number of large U.S. tech companies have recently announced plans to lay off employees.

In Europe, the S&P Global's final composite Purchasing Managers' Index (PMI) for the euro zone stood in the contraction territory at 47.3 in October, the weakest for nearly two years.

China’s exports to the U.S. contracted 12.6 percent in October, following a decline of 11.6 percent in September, and a decrease of 3.8 percent in August.

Exports to the EU retreated 9 percent in October, the first drop since the pandemic began.

The International Monetary Fund last month revised down 2022 growth forecast for advanced economies by 0.1 percentage points to 2.4 percent, citing a number of turbulent challenges such as inflation rarely seen in several decades, tightening financial conditions, the Russia-Ukraine conflict, and the lingering COVID-19 pandemic.

"This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic and reflects significant slowdowns for the largest economies."

—— IMF World Economic Outlook Report

China is not alone suffering from the downturn. The export-driven ROK has reported slower export growth since August too.

Making Exports Resilient

Exports is the second biggest driver of China’s growth. China’s economy grew 3 percent year on year in the first three quarter, with consumption, investment and exports contributing 1.2, 0.8 and 1.0 percentage points respectively.

Lackluster export performance put pressure on the outlook of the Chinese economy, and the remaining two months of this year may witness further challenges including resurgent Covid-19 cases in major export bases such as Guangdong.

As internal and external uncertainties jolted demand, it is more urgent for Chinese exporters to develop high value-added products to gain market shares, said experts.

Bucking the overall downward trend in October, China’s auto exports shot up 89.2 percent in value from a year earlier and its cellphone exports went up 7 percent, highlighting the competitiveness of high-tech products.

China earlier this week approved three new national manufacturing innovation centers, focusing on graphene, virtual reality, and ultra-high-definition video industries respectively, to boost support for the high-quality development of primary fields in manufacturing.

Gao Lingyun, a researcher with the Chinese Academy of Social Sciences said China also need to tap the potential of the RCEP, a regional free trade deal, to unleash the trade vitality with neighboring countries to offset the impact from a downturn in the European and U.S. markets.

The Regional Comprehensive Economic Partnership (RCEP) includes 10 ASEAN members, China, Japan, the Republic of Korea, Australia and New Zealand. Trade between China and other RCEP members accounted for about 30 percent of China’s total in yuan terms.

Since the RCEP came into force on Jan. 1 this year, it has proved promising. A sharp contrast to shrinking exports with the U.S. and the EU, China’s trade with ASEAN countries grew 20.3 percent year on year in October.

Looking into next year, experts are not positive about the global trade outlook amid broad pressure from soaring inflation, the Russia-Ukraine conflict and the Covid-19 epidemic.

The IMF last month slashed 2023 global growth forecast to 2.7 percent, down by 0.2 percentage points.

Zhou said the global headwind highlights the challenges for China’s exports and it is now more urgent to boost domestic consumption to shore up economic growth.