China's record high household savings, a guarantee for stronger spending power?

China's new household savings hit a record high in 2022. The fact has received mixed responses from policymakers and analysts.

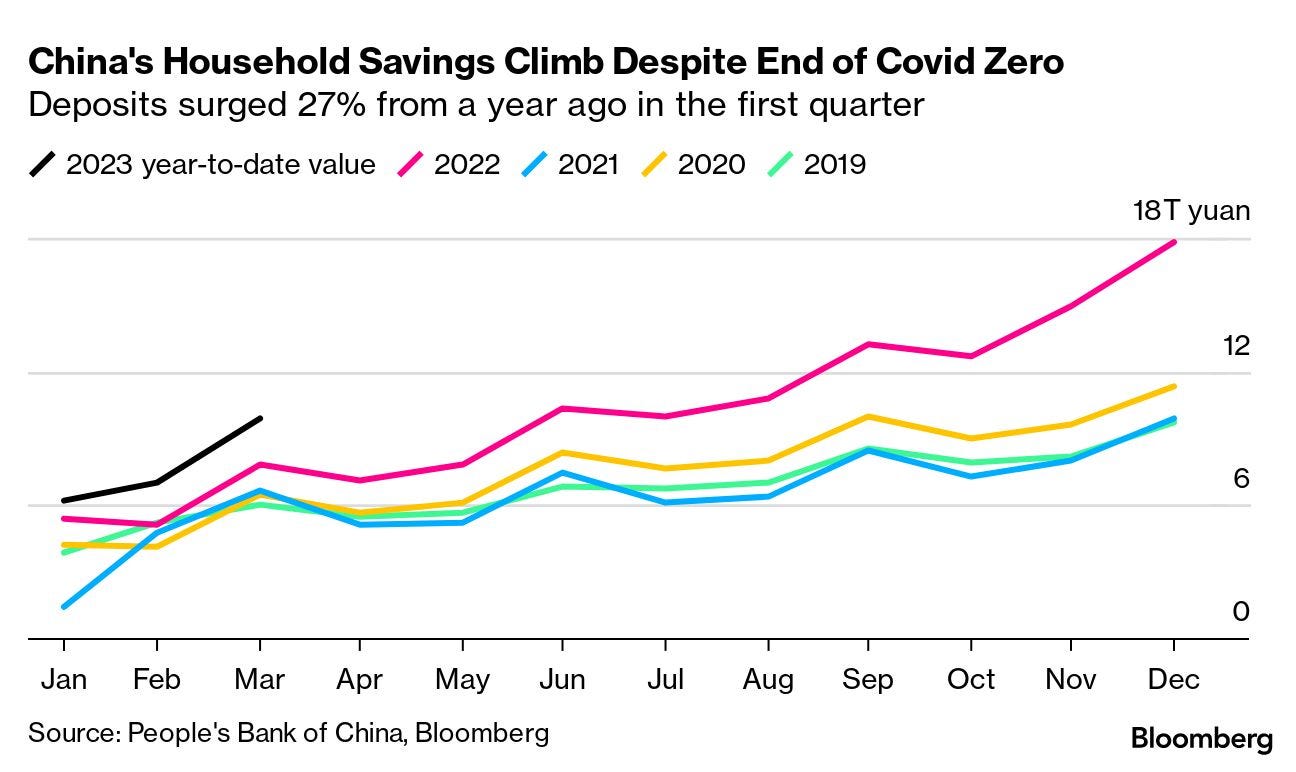

China's new household savings hit 17.84 trillion yuan (about 2.58 trillion U.S. dollars) last year, a record high since 2009, up by 7.94 trillion yuan from a year earlier.

This fact has received pretty much attention from policymakers and analysts, resulting in mixed responses.

Optimists see positiveness from these excess savings and are looking forward to a drastic rebound in family spending, as the optimization of COVID-19 responses and the reopening of Chinese economy are expected to unleash pent-up demand.

Critics say it is still too early to tell, as high deposits might not necessarily lead to high consumption.

※ HIGH DEPOSITS

Liu Guoqiang, deputy governor of the People's Bank of China, attributes the increase in savings to the changing sentiment over consumption and investment. For instance, the COVID-19 epidemic dampened residents' risk appetite and put a brake on investment expansion.

Wang Yongli, general manager of China International Futures Co., Ltd., noted that residents' income and expenditure had a great impact on deposits.

Last year, although the Chinese government increased subsidies, household income growth scale still shrank, affected by factors including COVID-19, economic slowdown, social employment instability and lower interest rates, he noted.

Expenditures on housing, education and medical care were greatly constrained, with several trillion yuan of year-on-year reduction, becoming the most important factor influencing the substantial growth of deposits year-on-year.

※ UNCERTAINTIES

At the beginning of the year, a prominent factor preventing consumption from a fast recovery was more psychological. People feared COVID-19 outbreaks could occur at any time and had to prepare themselves for a possible backlash.

Then the Spring Festival holiday came providing some comfort. Some 308 million domestic trips were made during China's weeklong Spring Festival holiday that ended on Jan. 27, up 23.1 percent from the same holiday last year, official data showed. The combined revenues of major businesses rose 6.8 percent from the last Spring Festival holiday.

What added to the optimism was the growing dynamics seen in a wider range of sectors in the latest Q1 data. China's value-added service output went up 5.4 percent year on year in Q1 2023, while the index gauging the country's service industry output rose 9.2 percent year on year in March, showing a quite positive signal.

Also, retail sales of consumer goods went up 5.8 percent year on year in Q1, reaching 11.49 trillion yuan, which was quite promising.

The central bank deputy governor claimed that as the recovery of the macro economy continues, people's confidence in consumption and investment will be further enhanced, and household savings may likely to gradually return to normal as well.

However, it's not all optimism. Wang argued that huge household deposits could not guarantee a retaliatory rebound in investment and consumption. The expectations of the whole society for future economic growth, employment stability, income growth and investment returns are crucial, Wang noted.

If income expectations become weaker, investment and consumption might flounder, which will decelerate the circulation of goods and capital, and a large amount of money will be deposited, which will further aggravate the economic downturn, increasing unemployment and social instability, he noted.

Another factor that can not be ignored when it comes to the prediction of consumption recovery is household debt, Liu Yuhui, an economic researcher at the Chinese Academy of Social Sciences, analyzed.

According to the statistics of the central bank, 700 million people in China are now in debt, Liu said, adding that the total debt of Chinese households accounts for 137.9 percent of their disposable income.

Annual interest payments already amount to nearly 15 percent of disposable income. Household payment ability has been noticeably constrained by high debt.

※ POTENTIAL

Despite these economic headwinds and the consumer confidence yet to recover, China's economy continues to exhibit a certain level of resilience, according to the 2023 McKinsey China Consumer Report released by the consulting firm McKinsey & Company.

The report highlighted five trends that are shaping consumer behavior. For instance, the double-digit growth of upper-middle and high-income households is powering robust consumption growth, while premium brands still outperform mass brands even during challenging times.

In the meantime, consumers are switching to cheaper channels and more aggressively seeking discounts and promotions, and know how to educate themselves about the technical specifications of their favorite products on social media, the report indicated, saying that consumers are also choosing local brands for their quality and innovation and not just for cheaper prices, or out of a sense of national pride.

To unleash the consumption potential, Chinese policymakers have set a clear-cut task to expand domestic consumption as a priority in 2023, with emphasis placed on enhancing people's spending power and creating new consumption scenarios.

At the end of last year, a slew of detailed measures have been rolled out to manage to restore and expand consumption.

Traditional consumption, including automobile, household appliances, home furnishing and catering, will be consolidated, the Ministry of Commerce (MOC) said, adding that it will support the purchase of new energy vehicles and smart home appliances.

New consumption scenarios and patterns, including digitalization of life services as well as integration of online and offline consumption, will be promoted, while green, smart and healthy consumption will also be advanced, according to the ministry.

The MOC also vowed to optimize consumption platforms, including smart commercial districts and smart stores in urban areas, and the county-level business system in rural areas.

Even though, China still faces an unbalanced money supply and consumer prices, with the M2 increasing 12.7 percent year on year to 281.46 trillion yuan at the end of last month, yet the CPI growth narrowed to 1.3 percent year on year in Q1.

Zou Lan, an official with the People's Bank of China, said that rapid monetary credit growth and a fall in the inflation rate were essentially a result of time lags.

Thanks for those stats. Very hard to find in English.