🔵Implications of the US chips act: supply chain, trade and more

Globalization, free trade, and fair competition, upon which the industry has prospered, are now at risk of losing relevance.

The greatest virtue is like water, nurturing all things without competing with them. - Lao Zi

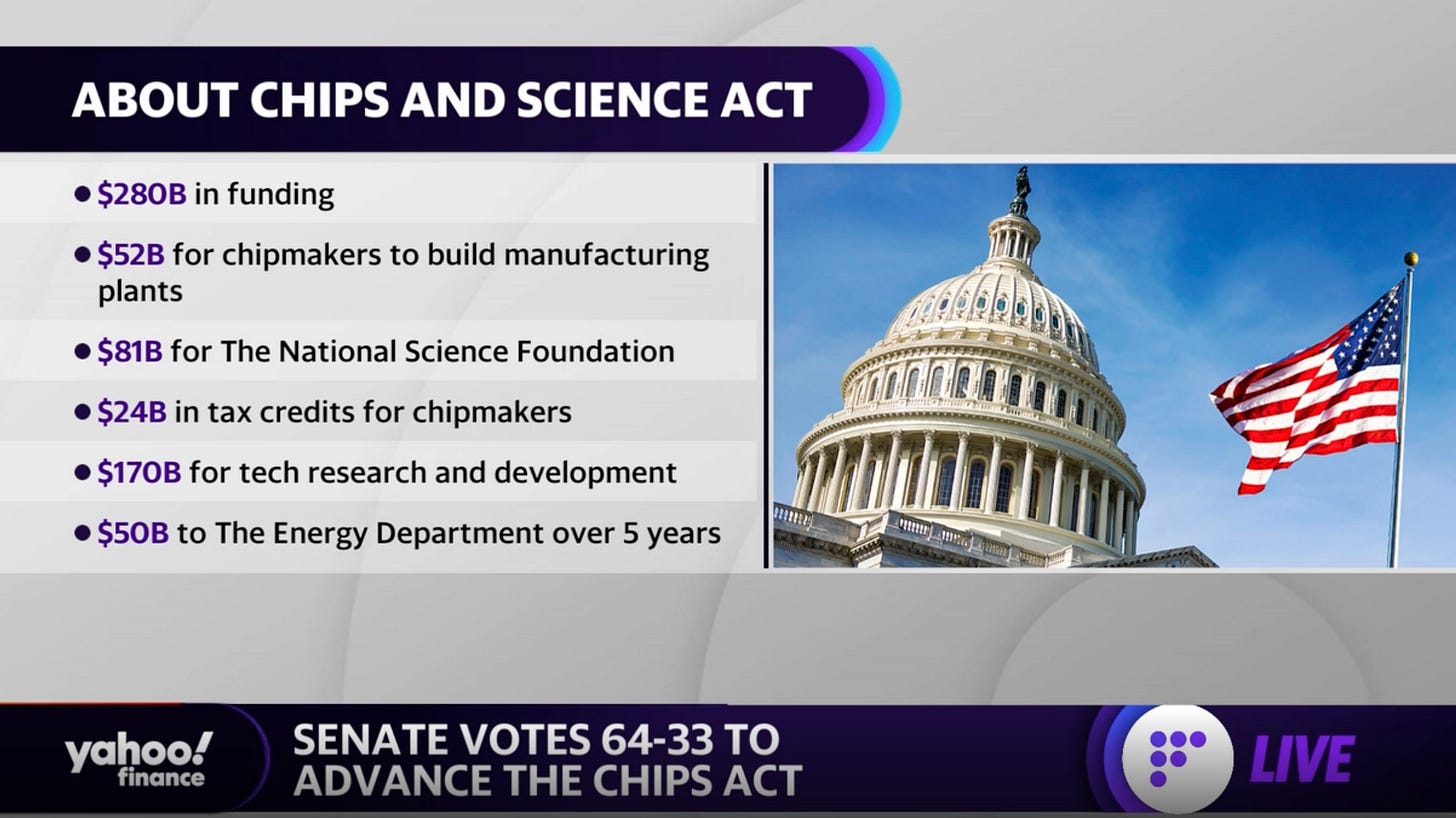

With the Chips and Science Act signed into law, the US government has gone to great lengths to reshape a strategic industry. Could US reshore chips manufacturing with $50 billion+ funds and how would globalization, free trade and the chips industry be affected? Analysts and industry insiders have raised their concerns.

AN UNDERRATED TASK

Policymakers could have underestimated the intricacy of the global chip supply chain, and the time and capital cost of building new chip fabrication plants, known as fabs.

For starters, chip production cannot thrive without a supply chain network steadily providing hundreds of raw materials and components. It takes more than 1,000 processes and 70 instances of cross-border cooperation to manufacture a chip, according to Li Yong, a senior fellow at the China Association of International Trade.

Such tremendous collaborative efforts are a reasonable choice based on a reality check: the difficulties of acquiring raw materials, and the few players capable of manufacturing sophisticated equipment and components.

A Nikkei Asia's in-depth report shows that only a few suppliers worldwide have the capability of producing semiconductor-grade valves and tubes for handling chemicals and not becoming a source of contamination. ASML of the Netherlands is the only provider of EUV machine, which is indispensable in the production of cutting-edge chips of 7 nm and below. Nearly 60% of the global output of the mineral fluorspar, used to produce fluoropolymers, comes from China.

How the US will pull itself together to get all the above-mentioned production capacity is a question. Not to mention the challenge of talent shortage facing the world's largest economy.

The human resource structure and reserve in the US today do not match the needs of the chips industry, noted Yu Qiang, professor of Beijing Technology and Business University, in a column on the Guangming Daily.

Semiconductor fabrication and R&D requires highly skilled talent, so the new US subsidies may not be enough in the absence of efforts to address the STEM talent shortage through education and immigration policy, according to associate professor of international studies at Indiana University Sarah Bauerle Danzman's analysis posted on the Washington Post. Although the chips act has workforce development provisions, it is silent on making it easier for STEM professionals to immigrate to the US, she pointed out.

The ALL-OF-AMERICA VISION

Making the matter more complicated is the White House's promise that the act "will ensure the future is made in ALL of America, and unlock opportunities in science and technology for those who have been historically left out."

Building new facilities or moving them is very expensive. Companies will not consider it unless they are sufficiently motivated by subsidies or tax breaks. Establishing new fabs is not a choice as good as reinvesting in existing factories. The chance is slim for those who have been left out to benefit.

Nathan Jensen, professor of government at The University of Texas at Austin, warned that pairing federal funding with state or local tax dollars could lead to fierce inter-state competition.

U.S. competitiveness could be inadvertently harmed by encouraging multinational corporations to extract money from local governments, including taking tax revenue away from cities, counties and our local schools, said Jensen.

A POLITICAL BATTLE

The White House said America today only produces about 10% of the world's supply and none of the most advanced chips, while East Asia accounts for 75% of global production. The chips act is expected to "strengthen American manufacturing, supply chains, and national security," and "keep the United States the leader in the industries of tomorrow."

The passage of this bipartisan bill shows the dominance of "America First" doctrine in the US political arena. The underlying meaning of the bill, as experts point out, is that by controlling both design and manufacturing of the chips that form the foundation of everything from automobiles to household appliances to defense systems, the US is politicizing the industry at the expense of other participants.

European Commission president Ursula von der Leyen said at the time the European Chips Act was enacted that "no country-and even no continent-can be entirely self-sufficient."

Although building a full supply chain within a single country is mission impossible, the White House could leverage the bill to befriend some and contain others.

The US Treasury Secretary Janet Yellen touted the "friend-shoring" strategy when she delivered a speech at LG Sciencepark in the Republic of Korea in July, claiming the strategy will strengthen economic resilience by working with allies and partners. Competitors of the US, or as the White House put it, "China and the countries of concern," will be countered.

Some analysts noted the consistent hypocrisy of US policymaking, which is intended to contain the high-technology industries of other countries. Monopoly, blackmail, and coercion could all come after US "secures" its chip production, and the global supply chain would not be safe anymore, said Li.

"FREE MARKET" SOURS

The protectionist move will also likely force other countries to follow suit and heavily subsidize industrial and supply chains of their own, thus derailing the current global cooperation and drifting away from marketization.

The European Union, Republic of Korea and Japan, among others, are all tilting resources to domestic semiconductor manufacturing. As countries prioritize self-sufficiency, costs will be higher, R&D development will be slower and efficiency will decrease, leading to underperformance of the industry. Companies that are not subsidized will be at disadvantage compared with those receiving government support, thus there will be fewer new entrants.

The chips act flies in the face of past US policies supporting the open multilateral trading system. It represents exactly the sort of policy that the US has accused China of pursuing, Anne O. Krueger, senior research professor of international economics at the Johns Hopkins University, wrote in an article for Project Syndicate.

There cannot be a competitive free market in semiconductors once some companies' plants are heavily subsidized. And it is worth remembering that competition is what made the US economy so productive in the first place, driving R&D in many fields, including semiconductors, the former World Bank chief economist wrote.

BRAKE ON INDUSTRIAL GROWTH

The US move adds to the downward pressure global chips industry already faces, as the pandemic in the past two years led to disparity between supply and demand.

The technological research and consulting firm Gartner projected the global semiconductor revenue to grow only 7.4% this year, down from 2021 growth of 26.3%, and forecast a 2.5% contraction in 2023 due to persistent weakness.

"Rising inflation, taxes and interest rates, together with higher energy and fuel costs, are putting pressure on consumer disposable income. This is affecting spending on electronic products such as PCs and smartphones," Gartner said. Worldwide PC shipments are on pace to decline 9.5% this year, according to its forecast.

Contrary to the glut in memory chips and PC processors is the supply crunch in automobile manufacturing and other industrial markets. On top of that, companies are caught in heated chips competition among countries.

Nvidia said last month the US government restricted its A100 and H100 integrated circuits exports to China and Russia. The restriction could cost the company $400 million in sales in China for the third fiscal quarter.

In a filing with the U.S. Securities and Exchange Commission, the company said it is "engaging with customers in China" and "seeking to satisfy their planned or future purchases of the company's data center products with products not subject to the new license requirement." Nvidia also said that it may seek licenses where replacements aren't sufficient.

Industry insiders have cited the geopolitical tensions and trade barriers as the biggest challenges of the semiconductor industry going forward. Globalization, free trade, and fair competition, upon which the industry has prospered, are now at risk of losing relevance.

Excellent coverage. Many thanks!!