IN-Depth: Huawei's breakthrough is unnerving Washington: a crime, a victory or a harbinger?

A group of U.S. lawmakers want full sanctions on Huawei after its new smartphone with an advanced China-made chip astonished the industry. These calls would lead nowhere.

Written by Joan Wang

Four years after the United States began to impose sanctions on Huawei, the company's new smartphone Mate 60 Pro, reportedly powered by a made-in-China 7-nanometer chip, has left Washington's Capitol Hill brimming with bewilderment, concern, and now anger.

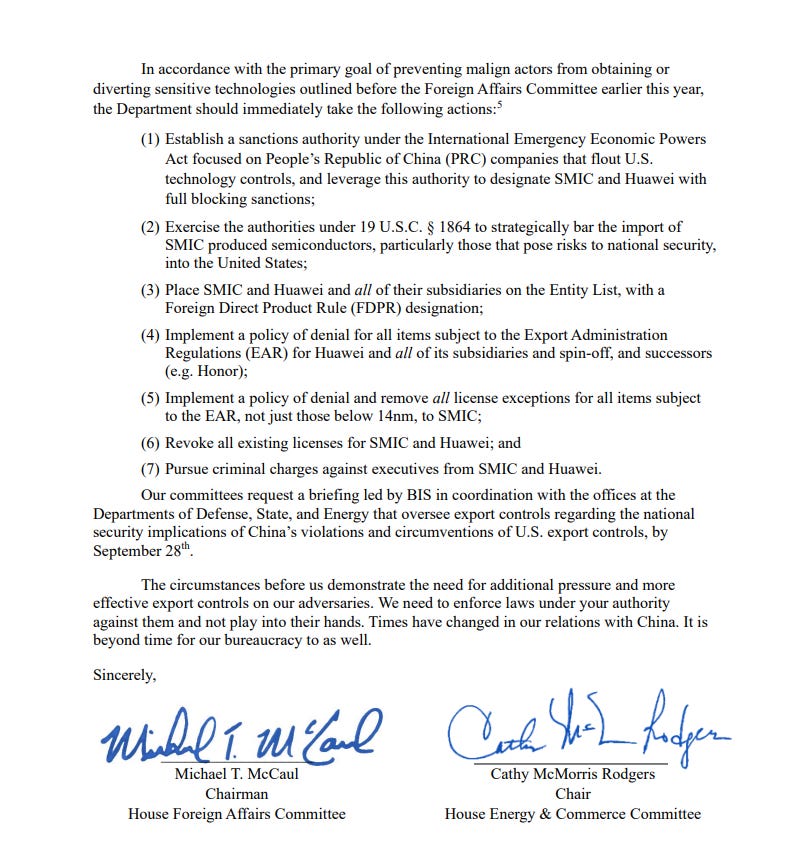

Led by House Foreign Affairs Chairman Michael McCaul, 10 Republican lawmakers wrote a letter last week to the undersecretary for industry and security at the U.S. Commerce Department, pressing for complete blocking sanctions against Huawei and SMIC, a Chinese chipmaker also hit by partial U.S. sanctions already.

Saying that they are "extremely troubled and perplexed" about the administration's inability to effectively enforce export controls against "violators, especially China," the lawmakers urged "criminal charges" against executives at both firms, according to a Bloomberg report.

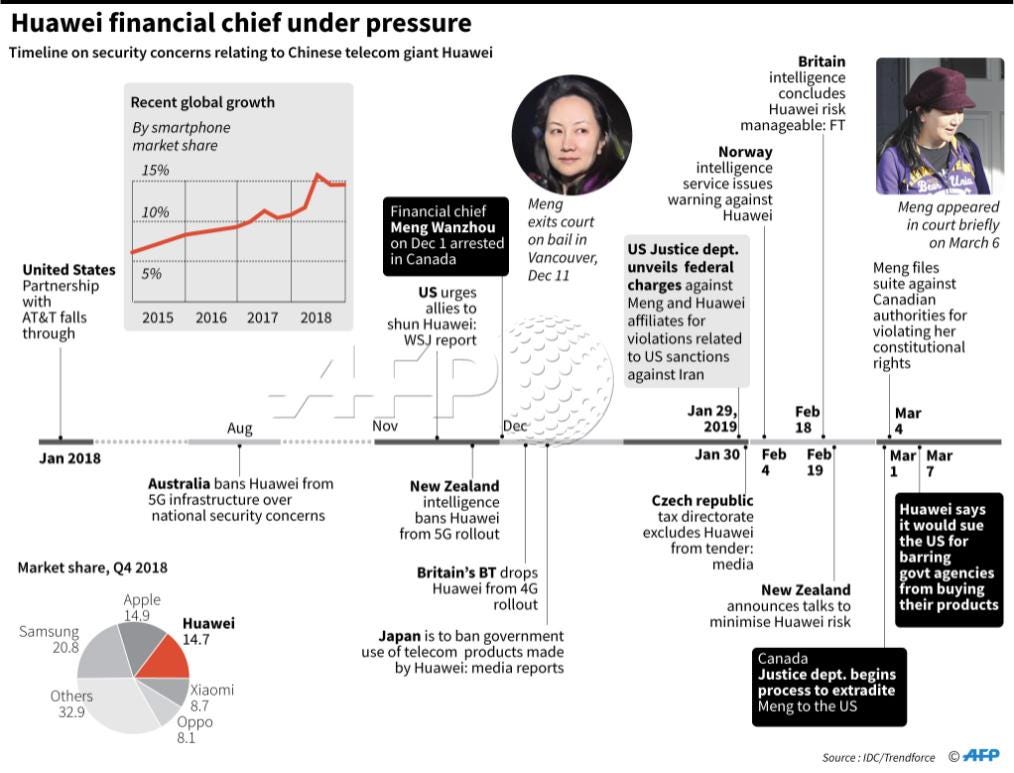

If such charges were laid, it would not be the first time that the United States wielded its judicial weaponry against the executives of one of China's most innovative companies.

Meng Wanzhou, chief financial officer of Huawei, was detained by Canada on a U.S. extradition request in 2018 and only returned to China almost three years later. Meng has pleaded not guilty to the criminal charges and a U.S. judge has eventually dismissed her indictment.

Meng's case has become a symbol of U.S. suppression on the Chinese technology industry.

Huawei will hold a press event to release its new products on Sept. 25, the second anniversary of Meng's return to China in 2021, seemingly to mark its comeback with 5G smartphones despite U.S. sanctions. Details about the company's new phones will be unveiled at the event, according to Chinese business news outlet Yicai.

Huawei's advancement is encouraging for China's high-tech industry striving for self-reliance and strength under U.S. pressure. Due to better than expected market response, Huawei has raised the shipment target for its Mate 60 series smartphones in H2 by 20 percent, Securities Daily reported, citing sources close to Huawei.

It is also surprising for the West.

As a Reuters report says, findings by analysis firm TechInsights and claims by early users about the phone's powerful performance indicate that "China is making some headway into developing high-end chips, even as Washington has over the recent years ramped up sanctions to cut its access to advanced chipmaking tools."

It's still too early to declare the breakthrough as a victory of China's fight against U.S. technology blockade. The chip used in Huawei's new phone is still significantly behind the world's best and its cost remains unknown, tech analysts say. But it is a successful reminder to the Biden administration that its approach to China's emerging technology prowess is coming to a dead end.

While Huawei's advancement may trigger even harsher actions from Washington, one question should be asked: be it criminal charges, restrictions, or sanctions, the U.S. hostility in its various forms has failed to hold back China's technological progress. Why?

It has to do with a fact ignored by China hawks in the United States: they are not just clamping down on a rising technology and economic powerhouse but also fighting a losing battle against the global trend of industrial chain integration, and the force of the market.

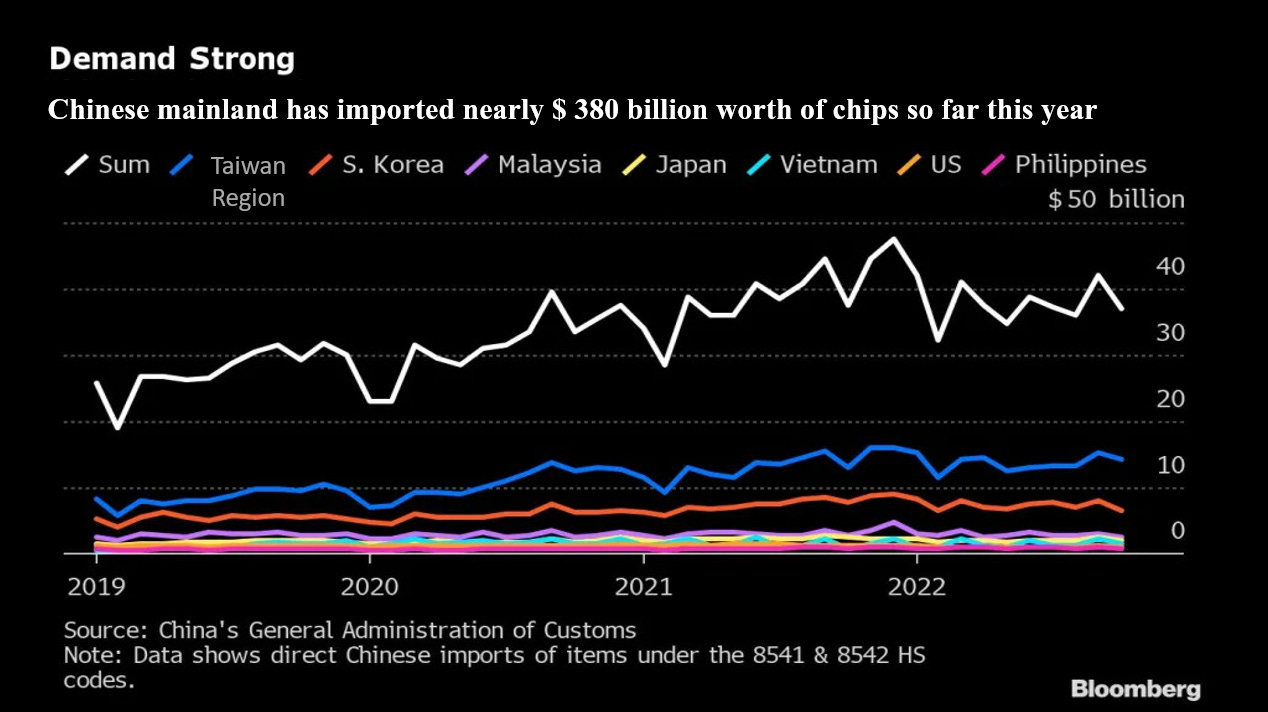

The Chinese mainland is crucial to the world’s semiconductor industry's supply chain, accounting for some 15 percent of microchip manufacturing, and that portion is set to grow, John Neuffer, president and CEO of the U.S. Semiconductor Industry Association said in a recent interview.

"All these global supply chains developed over decades for good reason. They are the most efficient and innovative way of manufacturing and designing semiconductors. If one country did try to move towards the whole supply chain internally, it would be prohibitively expensive and I think you would see a decline in innovation. No one company, no one country can do," he said.

Chip bans on China not just disrupt the global industrial chain but also locks Western advanced chip suppliers out of the world's biggest and most vibrant market.

As Ben Harburg, managing partner of the global investment firm MSA Capital, recently wrote on Fortune, "the CHIPS and Science Act cannot go on indefinitely subsidizing the U.S. semiconductor industry -- and there is no other global demand base to replace China's."

China's huge market demand and complete supply chains play a key role in driving the research and development as well as application of advanced technology. The U.S. attempts to hobble its technology capabilities will only force the country to accelerate its innovative paces.

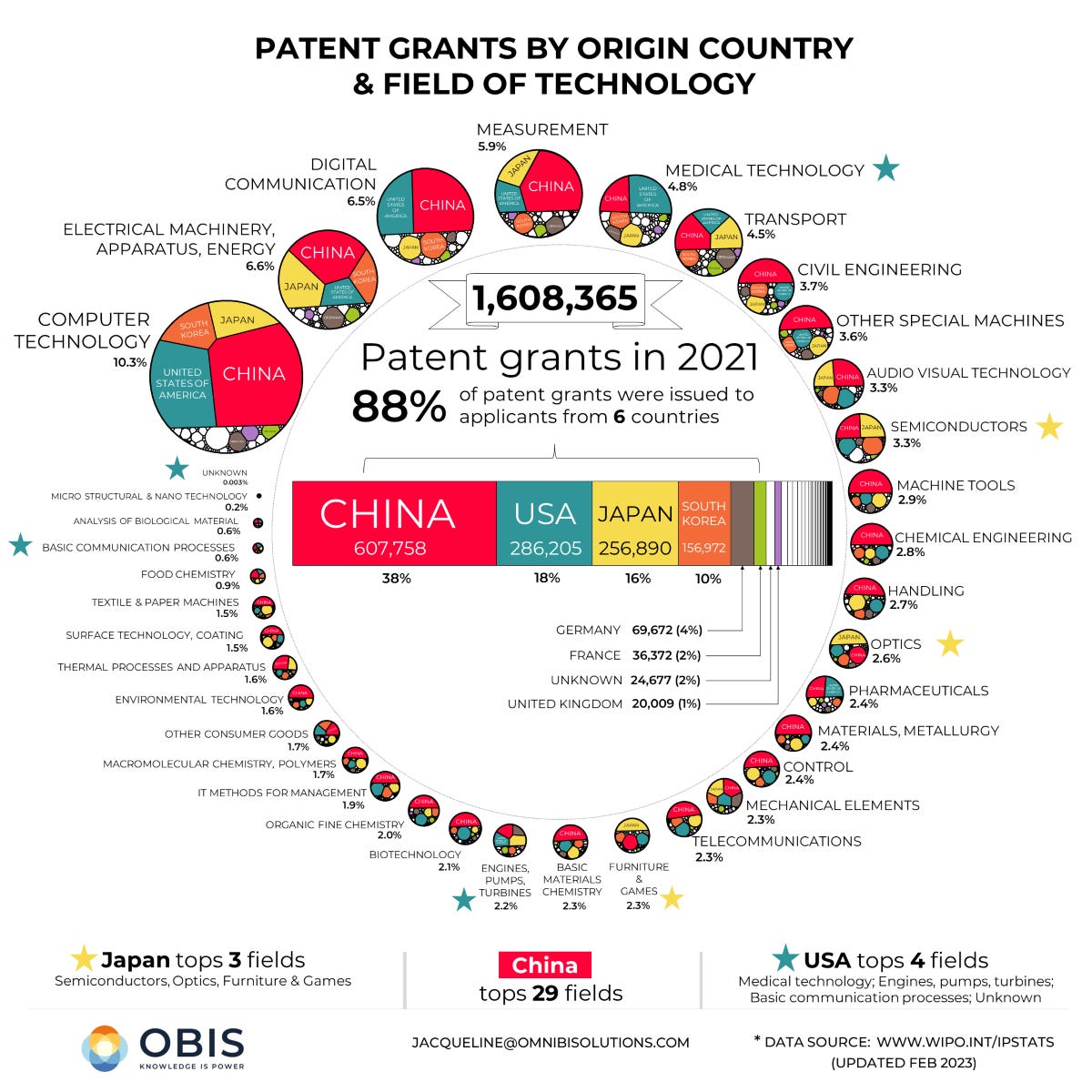

China has the biggest R&D talent pool, with its spending on R&D tripling in the past decade. Industries including new energy vehicles and industrial robots are booming. In 2022, it overtook the United States for the first time as the No.1 ranked country or territory for contributions to research articles published in the Nature Index group of high-quality natural-science journals.

Isolating China completely will be "hopeless" and "force" the country to ramp up innovation, said Peter Wennink, CEO of the ASML, one of the world's biggest chip equipment makers. "There are 1.4 billion Chinese, many of them smart. They come up with solutions that we have not yet thought of. You force them to become very innovative," Wennink told Dutch television programme Nieuwsuur.

Huawei's latest breakthrough is a statement of China's determination and capacity to fight back against U.S. tech hegemony, and a harbinger of what China can do and achieve in the face of blockade.

It is a wakeup call for the U.S. policy makers, too. In the Fortune article, Ben Harburg from MSA Capital argues that the success of the Huawei's new smartphone with its domestically produced 5G chip underscores the risks of driving Chinese innovation and self-sufficiency through decoupling.

"America now faces the short-term threat of losing the critical revenue that has fueled the research and development that made us an innovation leader, as well as the long-term inevitability that China will build its own full-scale semiconductor ecosystem. Ultimately, these actions will undermine American technological leadership and geopolitical leverage," Harburg wrote.