Key takeaways from Lujiazui Forum on China's new financial policy moves

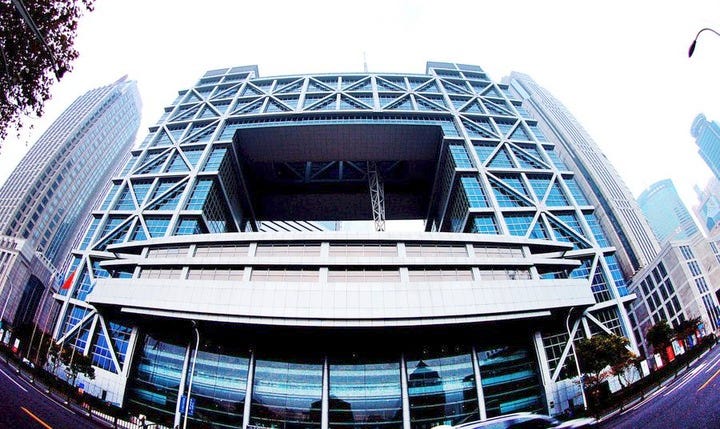

Heads of China's central bank, the National Financial Regulatory Administration, and other regulatory bodies met at the 2024 Lujiazui Forum on June 19 and conveyed the latest regulatory signals.

The forum, inaugurated in 2008, has become an authoritative domestic financial forum and a key international high-level dialogue platform.

⭐ Opening up

Li Yunze, head of the National Financial Regulatory Administration, said China welcomes foreign financial institutions and long-term capital to invest in China.

He emphasized the importance of piloting financial opening measures in Shanghai, supporting the city's development as an international financial center, and promoting the integrated development of the Yangtze River Delta.

Zhu Hexin, head of the State Administration of Foreign Exchange, said China will simplify and improve fund management for the dollar-denominated Qualified Foreign Institutional Investor scheme (QFII) and its yuan-denominated sibling, RQFII.

The QFII and RQFII programs are designed to allow overseas investors to invest in China's domestic capital markets.

He added that China will also support domestic institutions in making cross-border investments.

To meet the reasonable demand of domestic residents for overseas investment, China recently granted quotas totaling 2.27 billion U.S. dollars to 53 institutions under the Qualified Domestic Institutional Investor (QDII) program, which enables Chinese investors to access foreign assets.

On the sideline of the forum, the International Monetary Fund (IMF) Shanghai Regional Center was officially launched on June 19. China's central bank Governor Pan Gongsheng and IMF Managing Director Kristalina Georgieva spoke at the launching ceremony.

⭐ Patient Capital

Wu Qing, chairman of the China Securities Regulatory Commission, emphasized the efforts to strengthen patient capital, a term first introduced at a key meeting in April to refer to long-term investment eyeing sustainable growth.

Wu said developing patient capital aligns well with the nature of tech innovation enterprises characterized by high investment, long cycles, and significant uncertainties.

Wu said China will create conditions to attract more medium- to long-term funds into the capital market, and optimize policies supporting the entire investment chain, from venture capital to private equity.

The aim is to guide investments toward early-stage, small-scale, and hard-tech enterprises, fostering a positive cycle between technology, industry, and finance.

Chen Jining, secretary of the Shanghai Municipal Committee of the Communist Party of China, said the initiative to guide capital towards early-stage, small, and hard-tech enterprises was included in the 2024 Shanghai Government Work Report, aiming to boost investments in startups, small and micro-enterprises, and tech-driven companies.

Chen emphasized the need to provide efficient financial support tailored to different stages of technological innovation.

⭐ Fight against Financial Fraud

Wu Qing, chairman of the China Securities Regulatory Commission (CSRC) said that tackling financial fraud in listed companies remains a top regulatory priority.

The CSRC is working with relevant departments to establish a comprehensive system for prevention and punishment, enhancing penetrating regulation, encouraging whistleblowers, and holding intermediaries like investment banks and auditors accountable.

He added that both fraudsters and their accomplices will be fully investigated and held accountable, including criminal prosecution where applicable.

Wu emphasized the importance of investor protection during delistings, stating that violations and illegal activities will be thoroughly investigated and strictly punished.

⭐ Media Reports

According to a China Daily report, China's top financial regulators stressed financial sector's opening-up and the development of real economy at the Lujiazui Forum in Shanghai.

Link to : Financial reforms in focus at forum

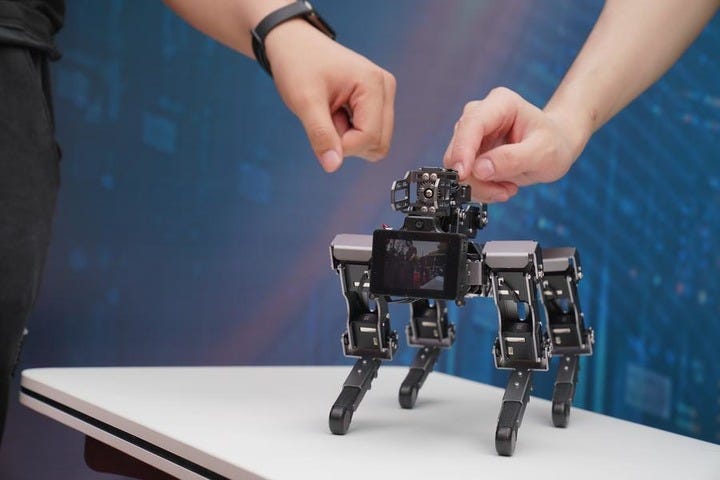

Xinhua reported that Chinese government pledged to advance China's high-standard financial opening-up and improve the financial sector's support for the real economy, especially new quality productive forces.

Link to : Voices on China's financial market reform, opening up at Shanghai Lujiazui Forum

According to a Xinhua report, Pan Gongsheng, governor of the People's Bank of China (PBOC) said China will continue to keep its monetary policy accommodative as well as strengthen counter-cyclical and inter-temporal adjustments.

Link to: China to keep monetary policy accommodative: central bank governor

Other links:

Written by Qiao H.