🏭 Staying in China: why "decoupling" is a bad idea for foreign businesses

In a world where economies are deeply interwoven with one another, the tangible benefits of cooperation far outweigh the illusory security of isolation.

Appreciate the culture/values of others as do to one's own, and the world will become a harmonious whole.

—— Fei Xiaotong (Chinese anthropologist and sociologist)

For foreign businesses keen on the Chinese market, the past two to three weeks are marked by some headline news that are worth further digesting and discussing.

While continuing to pursue "dynamic zero-COVID" policy, China has scrapped circuit breaker mechanism for inbound flights and reduced the quarantine time and PCR test requirement for inbound travelers, which helps to facilitate cross-border personnel travel.

After German Chancellor Olaf Scholz's visit to China, eight chief executives of top German businesses wrote in a newspaper article to warn against withdrawing from China, arguing that presence in China -- the world's second-biggest and most dynamic market -- is particularly important in the interest of German economic strength.

The fifth China International Import Expo (CIIE) became an increasingly important platform for foreign firms' business matchmaking. A total of 73.5 billion U.S. dollars worth of tentative deals were reached for one-year purchases of goods and services, up 3.9 percent from that of last year.

The U.S. side has no intention to seek "decoupling" from China, U.S. President Joe Biden said in a meeting with Chinese President Xi Jinping ahead of G20 summit in Indonesia.

These developments and voices are telling a much different story from what advocates of "decoupling from China" theories would like to present. A "decoupled" future is not in the favor of business leaders, to say the least, and China is particularly an unmissable market and investment destination.

THE BIGGER PICTURE

With the world economy facing turbulence and disruptions, it is normal to see some adjustments of business operations. However, the bigger picture should not be ignored or denied: staying in China rather than leaving the country remains a far better choice.

While some companies have redirected planned China investments to other destinations in the past year, the majority are keeping their footprint and operations in China and focusing on localization strategies, according to a survey from the American Chamber of Commerce in Shanghai released at the end of October.

Of the survey's respondents, 30 percent increased investment in China this year compared to last year for growth potential of the Chinese market.

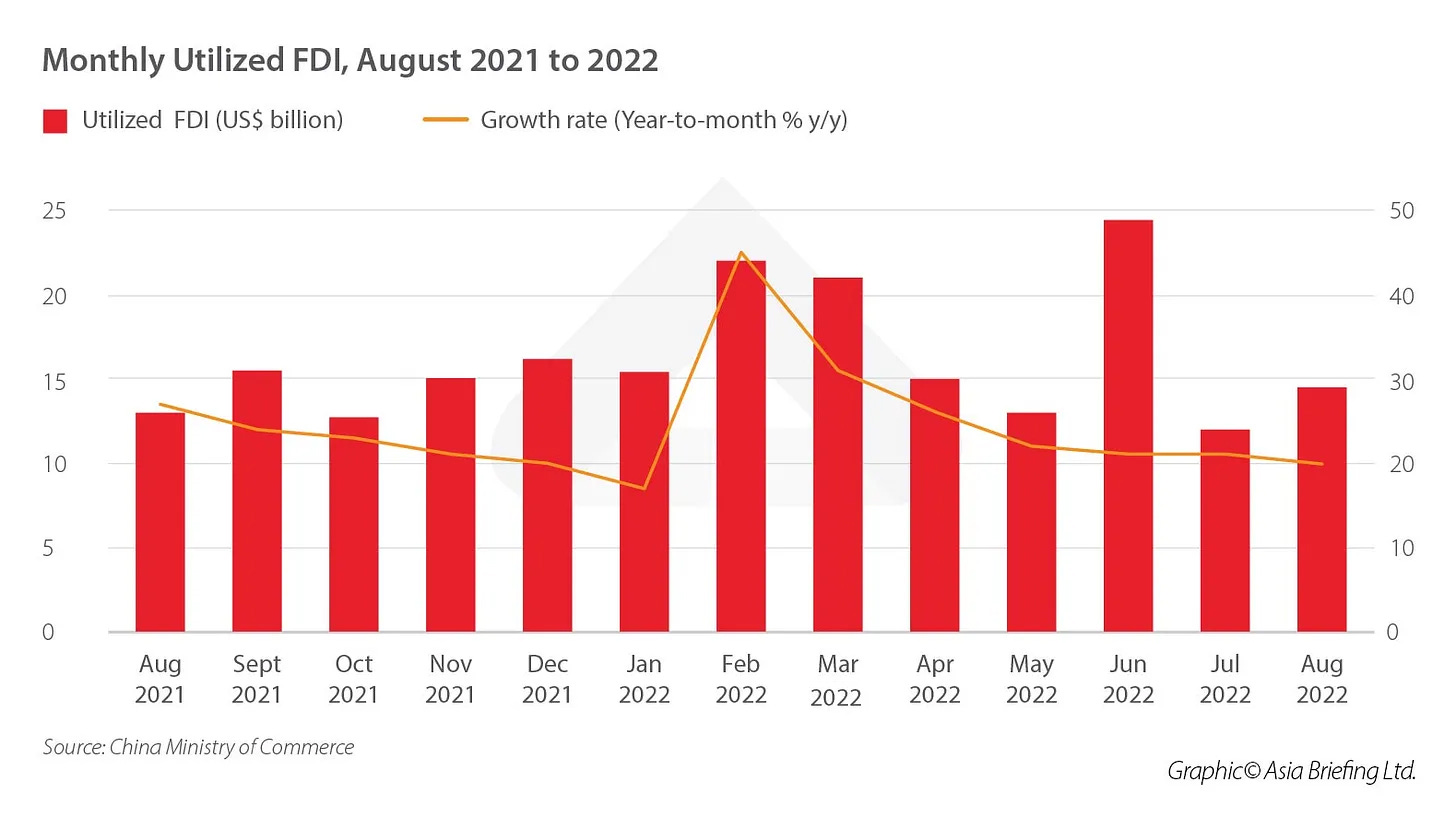

Data from China's Ministry of Commerce also proved how valuable it is to do business in China. In U.S. dollar terms, foreign direct investment into the Chinese mainland, in actual use, rose 17.4 percent year on year to 168.34 billion U.S. dollars in the first 10 months of the year.

Foreign businesses' interest in the Chinese market remains strong though uncertainties and protectionism are rising.

More than 280 of the world's top 500 enterprises and industry giants participated in this year's CIIE, held in Shanghai from Nov. 5 to 10.

Semiconductor companies such as Intel( INTC 0.00%↑ ), AMD ( AMD 0.00%↑ ), Qualcomm ( QCOM 0.00%↑ ), ASML ( ASML 0.00%↑ ) participated in the expo, despite U.S government's restrictions on advanced chip exports to China.

European chipmakers also attach much importance to the Chinese market.

During a recent semiconductor trade show, chief executives of STMicroelectronics ( STM 0.00%↑ ) , Infineon, and NXP Semiconductors ( NXPI 0.00%↑ ) said that while they are in compliance with Washington's export restrictions, they have no plans to halt their operations in China, according to the Financial Times.

China is about 30 percent of our total revenue, and this is the market we do not want to escape, we want to continue to support.

——Jean-Marc Chery (STMicroelectronics chief executive)

The appeal of the Chinese market can also be partly shown in the composition of the German business delegation led by Scholz in his visit to China: bosses of 12 top German companies such as Volkswagen, BASF, and Deutsche Bank, giants in sectors ranging from cars to chemicals and banking.

Germans should "step away from China-bashing and look at ourselves a bit self-critically," BASF CEO Martin Brudermueller said.

The German chemical giant has inaugurated the first plant of its new Verbund site in southern China earlier this year and will invest in a new world-scale Neopentyl Glycol (NPG) plant with an annual production capacity of 80,000 tonnes at the site.

WHY CHINA?

People might wonder why it has to be China? Why can't we just relocate factories elsewhere?

A recent news report from Wall Street Journal on the experience of an American entrepreneur may explain China's attractiveness for foreign businesses.

The kitchenware producer Velong Enterprises Co. has six factories in the Chinese mainland.

The company’s Co-chief Executive Jacob Rothman also opened factories in other countries like Cambodia, Vietnam, Turkey and India, but operations in these places were far from satisfaction in terms of capacity, people, raw materials, etc., when compared with China.

There's nothing like China. We've built this supply chain for 30 years to work like a Swiss clock.

—— Jacob Rothman (Co-chief Executive of Velong Enterprises)

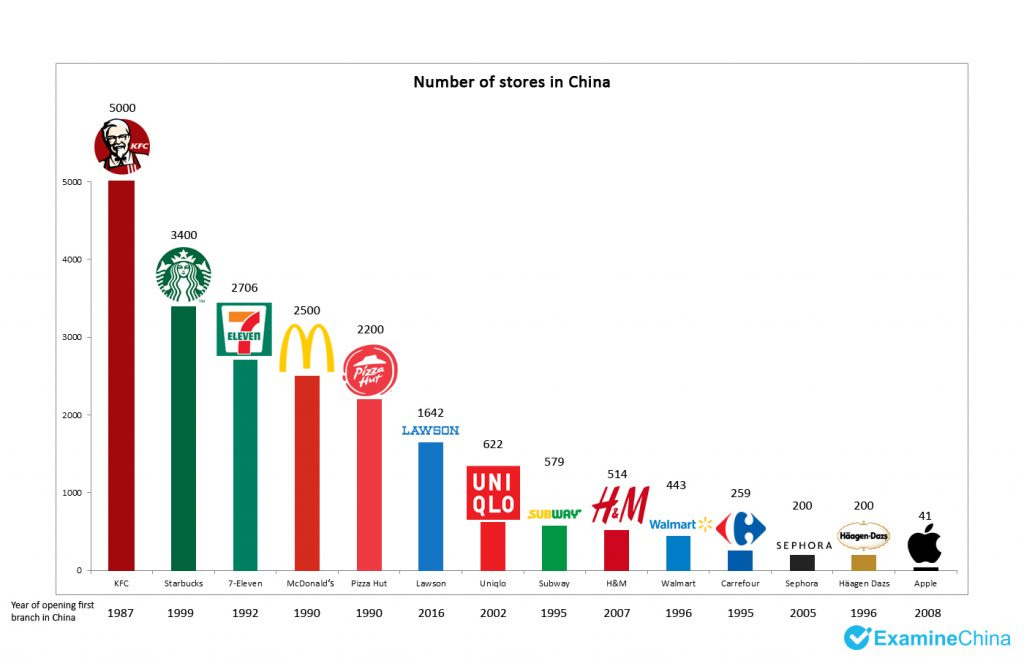

Like Rothman, foreign businesses find China hard to resist as it boasts the world's largest and most complete industrial system, sound infrastructure foundation, and a vast domestic market of over 1.4 billion people. Many of these advantages are irreplaceable so far.

Leaving China means years of investment and operations turn into nothing. Meanwhile, foreign businesses need to answer a simple question of where they can find such a big market and production base to compensate for the losses.

On top of existing favorable conditions, China continues to open its doors to the world.

Pro-foreign investment policies have been rolled out. China issued a 15-point document focusing on promoting foreign investment especially in manufacturing, days after the 20th National Congress of the Communist Party of China (CPC) during which the CPC pledged to promote high-standard opening up.

Foreign investors are encouraged to expand their footprints in fields such as sci-tech innovation, carbon peaking and neutrality, as well as in China's central, western and northeastern regions.

The country also issued a new catalog of industries where foreign investment will be encouraged, with 239 new items added to the catalog.

IS THE RELIANCE ON CHINA "OVERBLOWN?"

One underlying argument behind most decoupling discussion is that there is too much economic dependence on China, so it is necessary to increase goods diversification to ensure supply chain security.

Of course, companies can freely choose to diversify their supply chains or not, but two things worth attention: 1) whether China's economic impact is exaggerated in this process, 2) the fact that dependence is mutual is neglected under the "national security mindset."

For Joerg Wuttke, President of the EU Chamber of Commerce in China, "the dependency discussion is totally overblown."

"Where we're [Germany is] really dependent on is rare earths, pharmaceutical precursors …… that's where we have to look into, but these are 20, 30 items out of thousands of items," Wuttke was quoted as saying in a CNBC report.

As the world needs China for goods, China also relies on the rest of the world for its exports, which help propel economic growth and create jobs.

In the first three quarters of 2022, China's net exports of goods and services contributed 32 percent to its economic expansion, driving up the country's GDP by 1 percentage point.

Meanwhile, foreign companies have made important contributions to the country's economic growth. Accounting for only 2 percent of the number of China's market entities, foreign companies have created about 40 million jobs, contributing one-sixth of China's tax revenue and two-fifths of the country's imports and exports, official data has showed.

In other words, globalization leads to a highly interdependent network between China and the rest of the world. The cost of completely cutting China off the global supply chains is expected to be very high.

As the country continues to open its market to the world and aims to have a middle-income group of over 800 million in the next 15 years, the enormous opportunities are hard to neglect.