Time to turn bullish on Chinese economy

Policymakers sent a strong signal that the country will be in full swing to shore up post-pandemic recovery at a key conference mapping out priorities for 2024.

It has become a foregone conclusion that China will achieve its growth target this year to remain as one of the best-performing major economies in the world. However, looming challenges, including a deepening housing crisis and mounting local government debt, still spooked skittish foreign investors and stoked concerns about an economic slowdown. Rating agency Moody's just downgraded its outlook for Chinese sovereign bonds from stable to negative.

Such pessimistic sentiment should be largely dispersed by a high-level conference held in Beijing earlier this week.

According to a lengthy statement released after the annual Central Economic Work Conference, Chinese President Xi Jinping and other leaders decided priorities for the economic work in 2024: promoting scientific and technological innovation, expanding domestic demand, deepening reform in key areas, expanding high-level opening up, and defusing major risks, among others.

The wording of the statement was unusually strong. The leadership asked officials to "seize all favorable opportunities, take advantage of all favorable conditions, move swiftly when seeing the right direction, and work as much as possible." A signal was sent that the country will go all-out to prop up the economy.

The meeting acknowledged a series of existing problems -- lack of effective demand, overcapacity in some sectors, weak expectations, and risks and hidden dangers -- and promised to roll out more policies that will help stabilize expectations, growth and employment in a bid to consolidate the upward economic trend.

Macro Regulation

The government will strengthen counter-cyclical and cross-cyclical adjustments of macro policies and continue to implement a proactive fiscal policy and a prudent monetary policy with strengthened innovation and coordination of policy tools, according to the meeting.

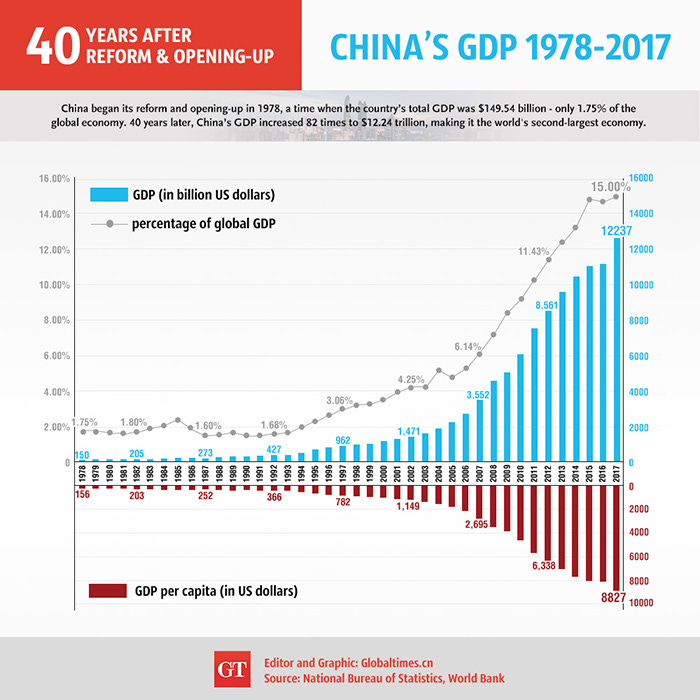

China's GDP expanded 5.2% from a year ago in the first three quarters of 2023, indicating a steady recovery. While the country is shifting to a green, innovative growth model, maintaining a stable economic increase is still important. More will be done to promote fiscal expansion and monetary easing, loosen real estate control, and stimulate the capital market.

"Establishing the new before abolishing the old" was a new, widely-watched expression in the statement. The phrase was originally used in the energy policy, which means that China will first build a reliable clean energy network before weaning off fossil fuels. At this conference, it was upgraded as one of the guiding principles for next year's economic work that will be applied to a wide range of areas. Under this philosophy, reforms will be accelerated, new growth drivers, such as high-tech industries and services, will see stronger support, the building of a new model in the property sector will pick up pace, and the renewable energy from solar power to hydropower will be more widely used, etc.

Fiscal and Monetary Policies

In terms of the fiscal policy, China will reasonably expand the use of special local government bonds as capital funds, continue structural tax and fee reductions, and support innovation and technology, as well as the manufacturing sector. As to the monetary policy, efforts will be made to maintain reasonable and sufficient liquidity, and keep social financing and money supply in line with the economic growth and price changes.

It has been clear that China's fiscal spending intensity will be stronger next year, with more funds going to technology, employment, social security, national defense, and education. More tax and fee reductions could also be expected to help ease the pressure on businesses, as the profits of industrial enterprises still saw a marginal decline in the first ten months this year.

As the U.S. Federal Reserve will likely start reducing interest rates in the second half of 2024, China will have more wiggle room for its domestic monetary policy, such as implementing interest rate cuts and lowering the amount of cash banks must hold as reserves. Money-starved property sector and local governments will be given stronger financial support, and green and tech industries, as well as small businesses, will also be benefited.

Sci-tech Innovation

Sci-tech innovation should lead the development of a modern industrial system. Efforts will be made to forge new industries, models and impetus with disruptive and cutting-edge technologies, such as biological manufacturing, commercial space industry and low-altitude economy, quantum technology, and life sciences.

The emphasis on disruptive and cutting-edge technologies came in as the United States intensified moves to block tech exports to China. However, China has appeared to make breakthroughs in multiple areas including new energy vehicles and large passenger aircraft. In particular, tech giant Huawei released in August its Mate 60 and Mate 60 Pro that reportedly feature 5G support, defying U.S. chip blockage.

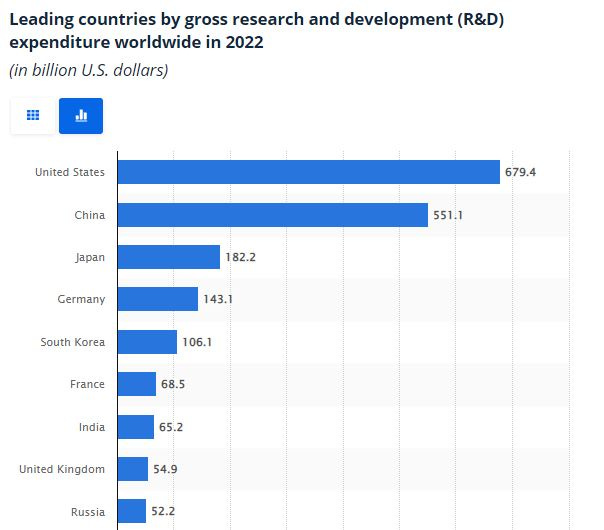

In 2022, China's high-tech manufacturing contributed 15.5% of industrial added value, and digital economy accounted for 41.5% of GDP. Over 60% of the world's 5G base stations are in China. The country's R&D input equaled to 2.54% of GDP, approaching the level of developed economies.

Domestic Demand

China will stimulate digital, green and health consumption, such as smart home appliances, entertainment and tourism, sports events and trendy domestic brands, and new energy vehicles. Efforts will be made to increase people's incomes and the scale of the middle-income group. New cooperation between governmental and private capital will be established, and private funds will be encouraged in new-type infrastructure, such as EV charging piles and big data centers.

The measures are clear and targeted as the aforementioned areas, such as EVs and tourism, do boast huge potential. While the real estate market continued to chill, consumers are more willing to spend in travel, dining-out, and electronic products. Especially, EVs have become a major bright spot this year and driven a strong rebound in the auto market.

Admittedly, China's consumer market only saw a mild recovery this year and consumer sentiment was still weaker than the pre-pandemic level. Expanding domestic demand is high on the government's work agenda this year and will be a surefire priority in 2024.

The Property Sector

China will move to defuse risks in the property sector in an active and prudent manner. The reasonable financing needs of real estate enterprises of different ownership will be met with no discrimination. The building of a new development model for the real estate sector will be accelerated.

The property market is in the middle of a painful transformation, with falling home prices and investment. The expectations forming in the past two decades that home prices will only go up have started to change.

However, the sector and related industries are still crucial to the economy. The government has relaxed restrictions and in some places started to encourage home purchases this year. The goal should be gradually containing the home price bubble before it outbursts, saving good property developers to prevent a widespread collapse, and leading the sector to a more stable and sustainable development path.

Opening up

China will foster new drivers of foreign trade, consolidate the overall performance of trade and foreign investment, and expand the intermediate goods trade, service trade, digital trade and cross-border e-commerce export. Market access for telecommunications, medical and other service industries shall be eased, and issues such as cross-border data flow and equal participation in government procurement will be resolved.

The meeting reconfirmed China's commitment to opening up. While some countries including the United States are turning to protectionism and unilateralism, China has become arguably the major advocate of free trade and an open global economy, with the Belt and Road Initiative as a perfect example.

Although reports on foreign investment withdrawal could be heard now and then, the Chinese market is unmissable to global investors and businesses. The country has said it will continue to shorten its negative list for foreign investment, open more sectors ranging from services to manufacturing, and join more international free trade pacts to further integrate into the world.

Private Economy

China will promote the development of private enterprises, with a number of favorable measures in market access, access to factors of production, fair law enforcement, and protection of their rights and interests.

The leadership reiterated the support for the private economy. In fact, an array of policies have come out this year to help private enterprises weather economic headwinds, covering a wide rage of areas including financing, business environment, innovation and regulation.

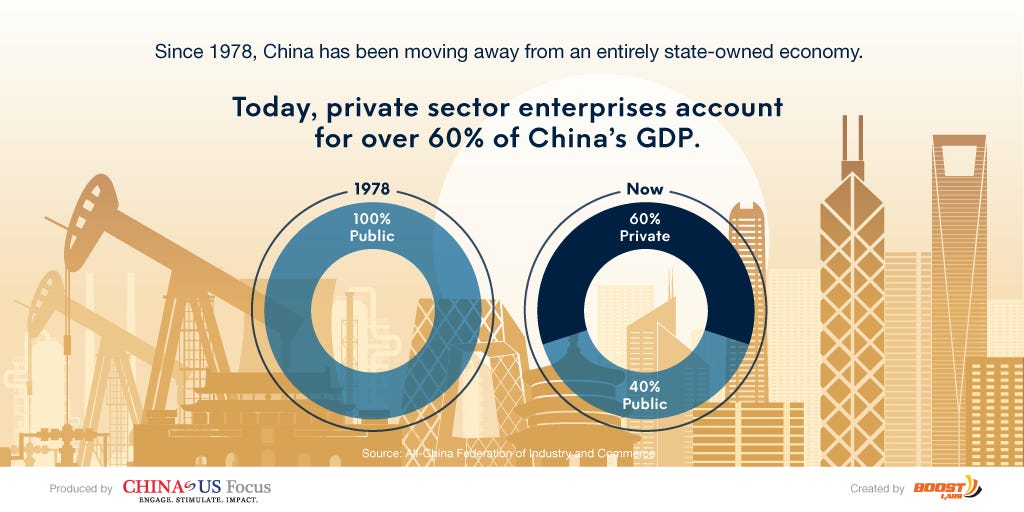

While China owns dominant state-owned enterprises, the private economy is still irreplaceable. It contributes over 50 percent to China's tax revenue and 60 percent to its GDP, creates over 80 percent of urban jobs, and make up over 90 percent of business entities. It's highly unlikely and unwise for China to suppress the private enterprises.

In general, the meeting testified that China has firm determination in spurring economic growth and promoting reforms and upgrades as well. In the face of rising complexity and uncertainty at home and abroad, China's advantages are also palpable: a strong will of the leadership, effective economic governance, a huge domestic market, a well-rounded industrial system, seemingly unstoppable technological breakthroughs, etc. People who bet on a China collapse during the pandemic now have every reason to turn bullish on the country.