U.S. overcapacity accusation against China: fact or fallacy?

Hyping up China's "overcapacity" in new energy sector, Washington has escalated tensions by imposing additional tariffs on Chinese imports. Are such actions justified?

In this post, Peking Ensight recommends the latest episode of the China Economic Roundtable hosted by Xinhua News Agency. The episode features panelists sharing their insights into China's ever-growing new energy sector and the controversial issue of "overcapacity."

The episode offers no harsh rebuttals to the U.S. accusations of overcapacity in China, but informative discussions on the evolution of China's new energy sector and its efforts to pursue broader cooperation amid global challenges.

Roundtable speakers include: Huo Fupeng, an official with the National Development and Reform Commission (abbreviated as NDRC, China's top economic planning organ), He Hailin, an official with the Ministry of Industry and Information Technology, Ding Weishun, an official with the Ministry of Commerce, and Qu Fengjie, a researcher with the Academy of Macroeconomic Research under the NDRC.

Below, we summarize key points from their perspectives, as well as some background information to help our readers better understand the issue.

Rising exports ≠ overcapacity

Responding to U.S. claims that China's increasing exports in new energy products are due to overcapacity, panelists unanimously describe these accusations as "baseless and contrary to common sense."

"International trade relies on countries' respective comparative advantages that enable global distribution and cooperation," Ding said, adding that developed countries like the U.S., Germany, and Japan have long been global exporters. "About 80 percent of U.S. chips are exported, as well as 80 percent of German automobiles and 50 percent of Japanese automobiles."

"For China, exports constitute a relatively small portion of its new energy sector, with most of the sector's products consumed in the domestic market," Ding said.

Data from the China Association of Automobile Manufacturers shows that the country manufactured a total of 9.59 million NEVs last year, with exports accounting for only 12.5 percent of the overall NEV production. Additionally, the export figure is minor compared with domestic sales of 8.3 million units last year.

Speaking of the relations between exports and overcapacity, Qu emphasized that the U.S. has applied a double standard when assessing the comparative advantages of the U.S. and China.

"China exports a wide range of home appliances, furnishings, electronics, and NEVs, while the U.S. focuses on the exports of aerospace products, automobiles, semiconductors, and medical devices. This shows that both countries are making the most of their comparative advantages," Qu said.

But when it comes to the case of China, the U.S. would accuse China of offloading overcapacity through exports, Qu said, adding that such accusations are politically motivated to hinder China's development.

Overcapacity card will only backfire

The U.S. protectionist measures to suppress China's burgeoning new energy sector under the guise of defending against the "Chinese overcapacity" will not only disrupt the global industrial and supply chains, but also hamper the global shift to sustainable and low-carbon development, according to the speakers.

In fact, it will be the U.S. itself that bears the brunt of the backfiring of its protectionist moves, Huo said.

Huo cited past examples, noting that over the past decade, some countries have resorted to protectionist measures to cocoon their iron and steel industries from global competition.

Without alleviating job losses, such measures have piled extra costs on their manufacturing industries, eroding their overall competitiveness as a consequence, Huo said.

"History has repeatedly proven that protectionism harms all parties involved, and no one ever benefits from it," he stressed.

A research report from the Peterson Institute for International Economics noted that Trump's protection of aluminum and steel and the trade war tariffs he imposed on China hit the US manufacturing sector hard.

Those tariffs were almost entirely absorbed by importers rather than passed on to foreign exporters, squeezing the formers' profit margins and reducing US manufacturing employment. The metals tariffs themselves caused the disappearance of an estimated 75,000 manufacturing jobs in the United States. US exporters have also struggled to compete for customers abroad because of the higher costs paid for metals at home.

What's worse, higher metals costs had made it difficult for American-made nails, bumpers, body stampings for tractors, wire, and cables to compete with imports, requiring yet another round of tariffs.

Double standards in subsidies breach market principles

Government subsidies are important for any sectors worldwide, including those in the U.S.. However, some U.S. politicians and media outlets claim that the rapid growth of China's new energy sector relies on heavy subsidies.

Responding to the remark, panelists at the roundtable reached a consensus that to decide whether a government subsidy is legitimate and necessary, one must refer to international market rules.

Ding said that with the U.S. itself being an example, the country's Inflation Reduction Act (IRA) introduced in 2022 has excluded NEVs, batteries, and key minerals produced in certain countries from receiving subsidies, running counter to the principles cherished by the global market.

Being discriminative and exclusive in essence, the IRA has not only breached the rules of the World Trade Organization but also undermined the spirit of free trade. It epitomizes blatant protectionism, Ding added.

In contrast, the Chinese government has continued to fine-tune its subsidies for the new energy sector to keep pace with the evolution of both the domestic and international market, Qu said.

According to the principles of economics, when a government introduces sectors that benefit society, the economy, and the environment, it should provide financial support to help them thrive, he said.

The Chinese government offered subsidies to the new energy sector in the early stage of the sector's development. As social investment now plays a major role in driving the sector's growth, government support is gradually being phased out to pave the way for a market-oriented growth model, Qu stressed.

More importantly, China's government support for the new energy sector extends beyond subsidies, encompassing a broad range that addresses both supply and demand, Qu said.

Its support measures include tax reductions and exemptions on NEV purchases, removal of NEV licensing restrictions, construction of charging infrastructure, government procurement policies, and financial support dedicated to cultivating advanced technologies.

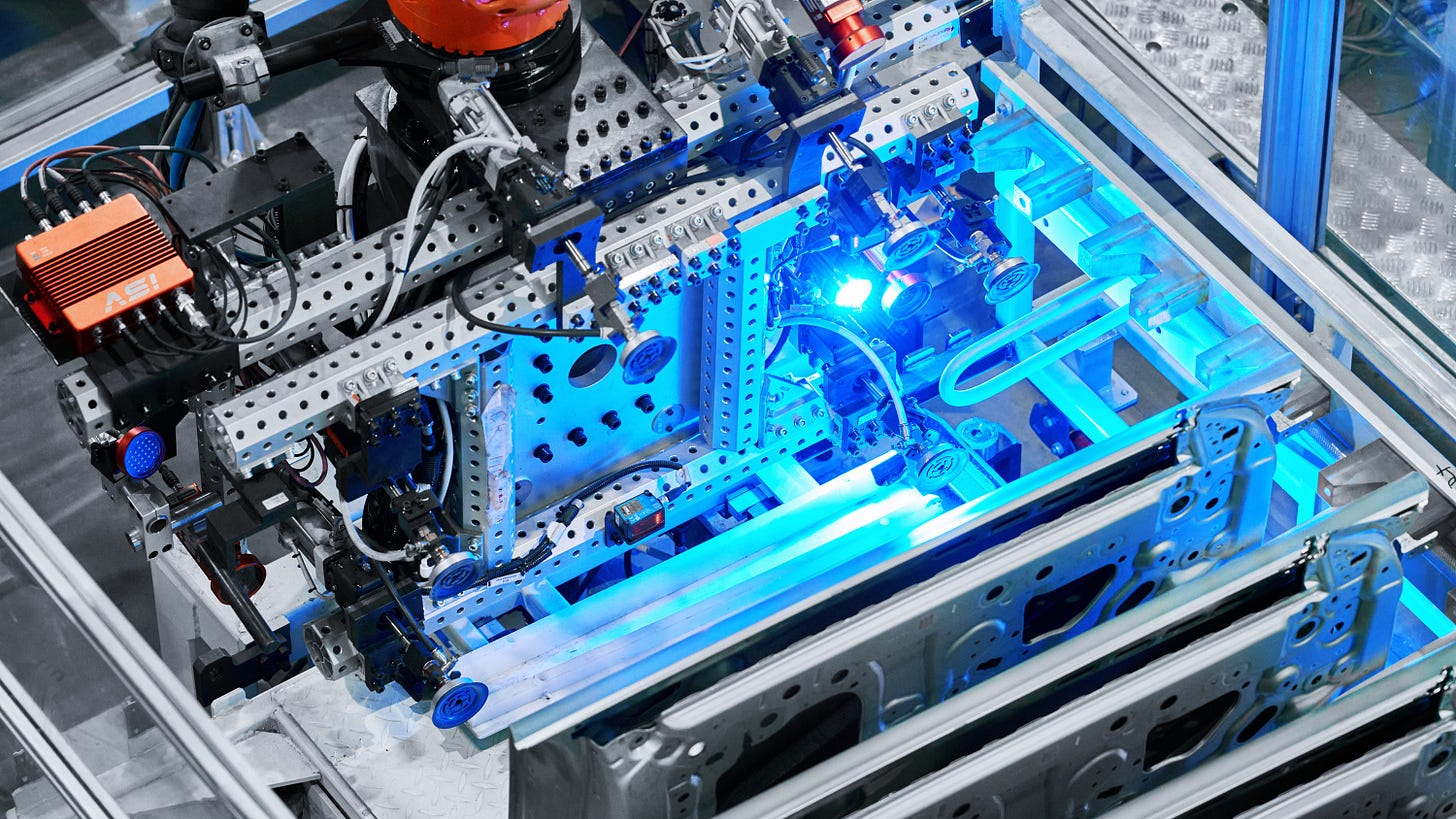

A large proportion of the policy support is directed towards sci-tech breakthroughs in its new energy sector. For instance, the country offers preferential tax treatments to incentivize corporate investment in technology research and development (R&D).

Bolstered by strong policy support, China's three leading new energy products -- NEVs, lithium batteries, and solar cells -- have topped global rankings in patent applications. The technological advancements of these products have boosted their global popularity and strengthened their influence in markets worldwide.

China leads global NEV market with sci-tech edges

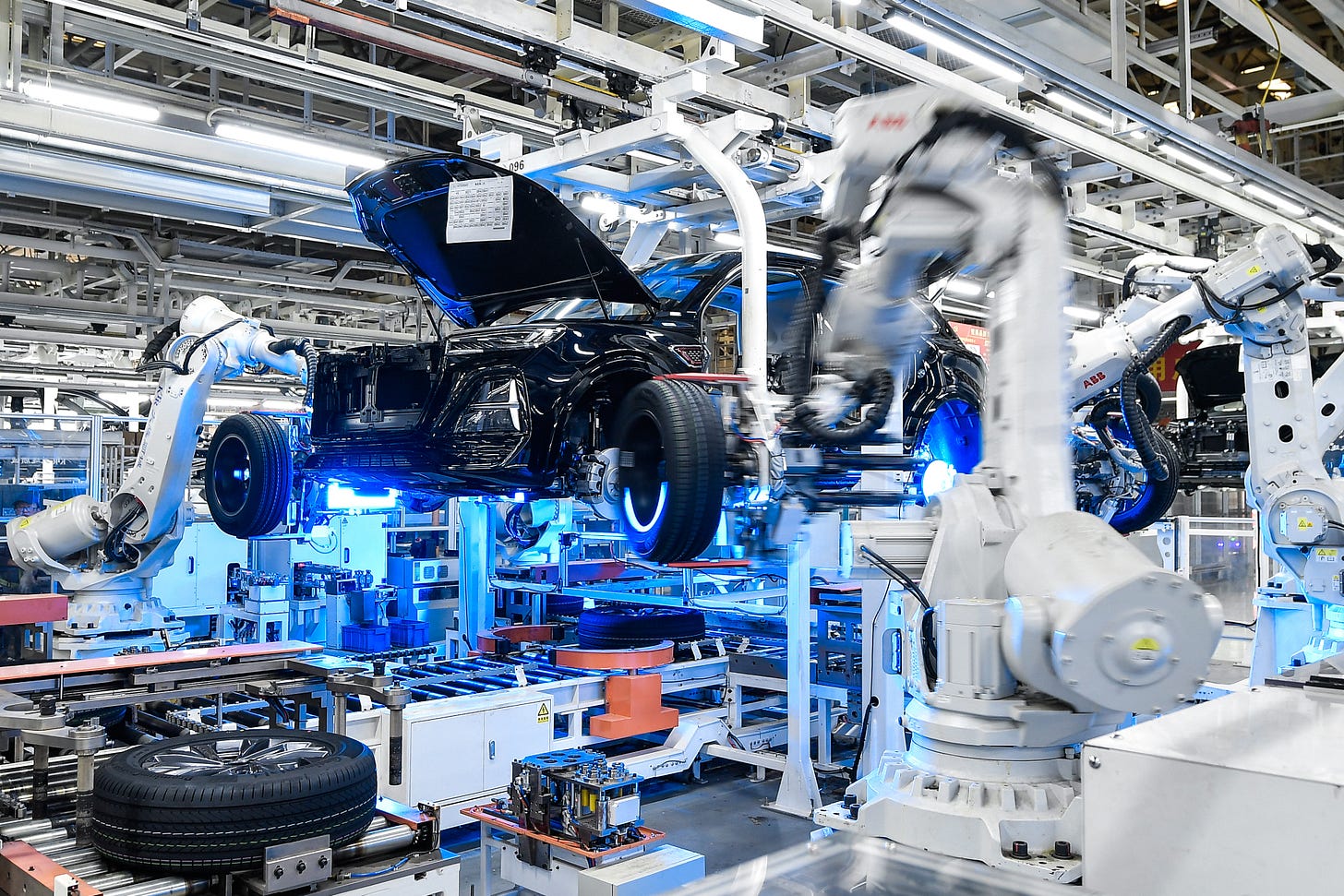

Thanks to its commitment to technological innovation, the Chinese NEV sector has fostered globally leading technologies in key components such as power batteries, driving motors, and operational systems. These advancements have remarkably enhanced the performance and safety of Chinese-made NEVs.

For Ding, Chinese NEVs have gained global popularity because they offer consumers cutting-edge technology at affordable prices. He stressed that China has made strides in both charging technology and automated driving.

A prime example is the recently launched NEV battery by Chinese new energy giant CATL. The battery, featuring ultra-fast charging capabilities, enables a 600-kilometer journey with just 10 minutes of charging.

Huo attributed the technological advantages of Chinese NEVs to China's robust industrial capabilities.

The country's extensive industrial and supply chains provide the NEV sector with everything from raw materials and batteries recycling to application scenarios and charging facilities, he said.

Huo said that China's vast domestic market has spurred NEV manufacturers to develop a broader range of models to cater to diverse consumer preferences. The enormous domestic demand stimulates suppliers to increase the variety of their products, thereby driving the growth of the sector.

He emphasized that China, as the world's largest automobile market, welcomes automakers from all across the globe. The country not only provides development opportunities, but also ensures a level playing field for global auto companies.

Cooperating towards a greener future

Speakers at the roundtable unanimously agree that developing the new energy sector is an effective way to facilitate green transformation, combat global warming, and accelerate global economic recovery.

They outlined five proposals for strengthening global cooperation on the new energy front, urging all countries around the world to:

Strengthen the alignment of policies and standards

Intensifying exchanges on policies and development plans for the new energy sector;

Unifying technological standards and certification mechanisms;

Fostering a mutually-recognized calculation system for carbon emissions;

Encourage tech innovation and sharing of outcomes

Fully leveraging the comparative advantages of all countries to solve common problems;

Expediting the research and development of key technologies;

Transforming sci-tech achievements into productive forces;

Guarantee fair global competition

Respecting all countries' development strategies;

Nurturing all market entities;

Promoting free trade with reduced tariffs for green products;

Maintain the stability of industrial and supply chains

Unclogging global industrial and supply chains;

Encouraging collaboration among companies;

Bolstering the integration of resources and infrastructure;

Create a worldwide talent pool

Increasing global talent exchanges;

Encouraging cross-border cooperation on education, professional training, and academic exchanges;

Cultivating professionals with a global vision and rich expertise in green sectors.

Written by Shaun G